A Tariff Can Best Be Described as

The aim of tariffs are to either raise the prices of imported products to at least the level of current domestic prices or increase revenue for the government. The Republican administrations of the 1920s would best be described as A possessing a foreign policy based on expansion and heavy domestic business regulation B supporting isolationism and laissez-faire business policies domestically C strongly focused on building up the armed forces D open to increased immigration and less stringent quotas.

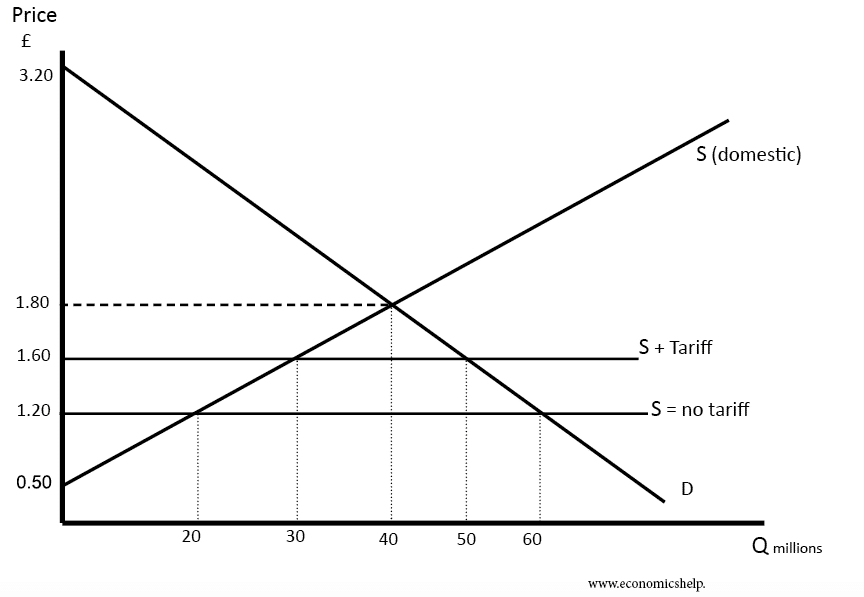

/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)

The Basics Of Tariffs And Trade Barriers

B a government payment to domestic producers to enable them to sell competitively in world markets.

. Ironic because the exact opposite happened. Tariffs are taxes or duties that are levied on imported goods. Can Tariffs Be Written off on Taxes.

Tariffs give a price advantage to. Law that sets a limit upon the amount of a good that can be imported e. A limit on the amount of imports C.

American car importers pay a 25 tariff on every auto brought in from Japan. A government payment to domestic producers to enable. Domestic consumers from foreign competition by lowering the domestic price of the good.

D a law that sets a limit on the amount of a good that can be imported. To raise government revenue. According to the World Trade Organization WTO.

Excise tax on an imported good law that sets a limit on the amount of a good that can be exported excise tax on an exported good government payment to domestic producers to enable them to sell competitively in world markets law that sets a limit upon the amount of a good that can be imported. Up to 256 cash back A tariff can best be described as A. One barrier to international trade is a tariff.

Domestic producers from foreign competition by raising the domestic price of the good. Progressive is a great insurance company. A tariff can best be described as A an excise tax on an imported good.

The following include several reasons that government might give for using a tariff on imports. Select the best answer of those given. As a result car dealers often increase their car prices by 25 or more to offset the import taxes.

A tariff can BEST be described as which of the following. The renaissance can best be described as a gradual change in the way people viewed things. For example if foreign companies have to adhere to complex manufacturing laws it can be difficult to trade.

B either a tax on or a limit on the quantity of an imported good. A system of government-imposed duties levied on imported or exported goods. If the rand appreciates against other currencies South African exports will become more competitive ceteris paribus.

These involve rules and regulations which make trade more difficult. A law that sets a limit on the amount of a good that can be imported. A tariff can best be described as.

An ad valorem import tariff is a percentage that is levied on the price of an imported good. Customs duties on merchandise imports are called tariffs. A either a tax on or a limit on the quantity of an imported good.

It is the tax that is paid when goods come into a country form another country. A law that sets a limited upon the amount of a good that can be imported. A government payment to domestic producers to enable them to sell competitively in world markets.

Herbert Hoovers prediction could best be described as a. An example of tariffs affecting consumers can be found in the automotive world. True because it happened just not in the time that he thought it would.

A tariff can best be described as. A government payment to domestic producers to enable them to sell competitively in world markets. False because it took longer to happen than he originally thought.

A tariff can best be described as an. An excise tax on an imported good. A tariff can best be described as.

A tariff can best be described as a n. An excise tax on an imported good. An excise tax on an imported good.

A tax on an imported good B. A specific import tariff is a fixed amount which is levied on each unit of an imported good. These are taxes on certain imports.

A tariff can best be described as. A tariff is a tax imposed on imported goods and services. Prophetic because it came true.

Government payments to domestic producers to help them compete in world markets D. An excise tax on an exported good. Excise tax on an exported good d.

A tariff is a tax that is imposed by a government on imported or exported goods. Government payment to domestic producers to enable them to sell competitively in world markets c. Excise tax on an imported good b.

They raise the price of imported goods making imports less competitive. April 1 2022 By. Hence a tariff is tax on an imported good.

A list of such duties or the duties themselves. Law that sets a limit on the amount of a good that can be exported. Does the company Progressive have the best auto insurance rates.

D a law that sets a limit on the amount of a good that can be imported. A an excise tax on an imported good. They are also known as customs duties.

C an excise tax on an exported good. Which is not valid in the sense that the effect described will not happen.

:max_bytes(150000):strip_icc()/TariffsAffectPrices2_2-f9bc0f6dc8f248eb8c6e22ad499b66c0.png)

The Basics Of Tariffs And Trade Barriers

No comments for "A Tariff Can Best Be Described as"

Post a Comment